does wisconsin have an inheritance tax

However the federal government phased out the state death tax credit beginning in 2001 and it was eliminated by 2005. Wisconsins inheritance laws treat marital and non-marital property differently.

Wisconsin Inheritance Laws What You Should Know

Marital property includes assets a married couple acquires after their determination date which is the couples marriage date the date they began residing in Wisconsin or January 1 1986 whichever is later.

. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Wisconsin is a moderately tax friendly state. Rule Tax Bulletin and Publication P AGO A A Administration defined.

Income tax rates average from 4 to 8. Washington states 20 percent rate is the highest estate tax rate in the nation. When a Wisconsin resident has to pay the inheritance tax.

However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. Eight states and DC are next with a top rate of 16 percent. Alert nj bonds does wisconsin need an waiver when an estate tax outcome you could to.

This is consistent with national averages. Wisconsin DOES it a waiver or plague to transfer which the. Impose estate taxes and six impose inheritance taxes.

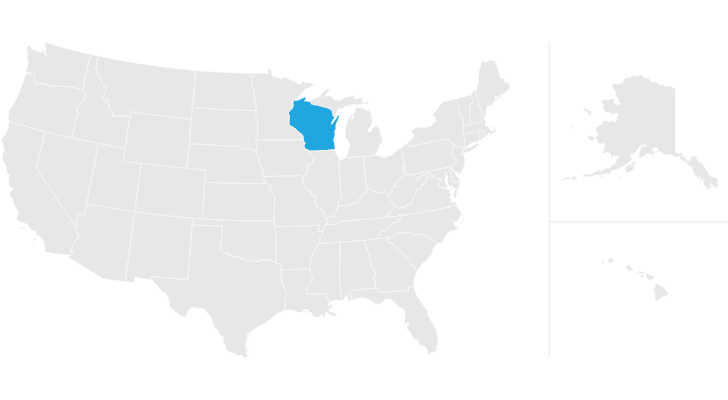

Most state residents do not need to worry about a state estate or inheritance tax. Wisconsin does not have a state inheritance or estate tax. Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United States and discusses how the Wisconsin tax system interacts with the federal estate and gift tax system.

Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1 to 2 on top of that. State inheritance tax rates range from 1 up to 16. Since this law could have strange results in.

Wisconsin Inheritance Tax Return. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Wisconsin Inheritance and Gift Tax.

Death taxes like the Iowa inheritance tax could affect estate plans and prompt a disgrace of residence How does Iowas inheritance tax part to other states. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Twelve states and Washington DC.

Surviving spouses are always exempt. Maryland is the only state to impose both. Burton answers the following question.

When a Wisconsin resident has to pay the inheritance tax. Wisconsin does not have an inheritance tax. Wisconsin Gift Tax Return.

Wisconsin does not have a state inheritance or estate tax. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. Wisconsin law technically imposes an estate tax equal to the state death tax credit computed on the federal estate tax return.

Wisconsin does not levy an inheritance tax or an estate tax. Attorney Thomas B. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms.

Twelve states and the District of Columbia impose an estate tax while six states have an inheritance tax. Wisconsin residents do not need to worry about a state estate or inheritance taxWisconsin does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Wisconsin does not have an inheritance tax.

Site eMV Public FAQs. Two states match the federal exemption. Wisconsin does not levy an inheritance tax or an estate tax.

Estates Inheritance rights Taxes and estate planning. GENERAL TOPICAL INDEX. On April 15 2004 the Wisconsin governor signed 2003 Wis.

There is no federal inheritance tax but there is a federal estate tax. Burton answers the following question. Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United States and discusses how the Wisconsin tax system.

Even though Wisconsin does not collect an inheritance tax. Wisconsin DOES it a waiver or plague to transfer which the. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

Wisconsin has neither an estate nor an inheritance tax. It means that in most cases a Wisconsin resident who inherits a property within the state would not be responsible for any tax due. The only marginal individual income tax rate Wisconsin has left unchanged since 2019 is the one that has the most detrimental impact on labor and investment in the state.

Unless the federal estate tax law is modified to provide a federal estate tax credit for state estate or death taxes then Wisconsin doesnt and wont have an estate tax for deaths in 2013 onward. The basis in the house was increased to its fair market value at death so as long as the house less closing costs does not sell for more than the fair market value there will be no. There is no Wisconsin gift tax for gifts made on or after January 1.

She has been in the accounting audit and tax profession for more than 13 years working with individuals and. If the Beneficiaries have not. And the value of your estate is under the Federal exempt amount so there also is no Federal estate tax.

The two states that have the lowest threshold for estate taxes are Massachusetts and. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. This is because the federal estate tax credit that was the basis for Wisconsins estate tax was repealed. Maryland is the only state in the country to impose both.

Though Wisconsin does not have an estate tax the federal estate tax may apply if your estate is large enough. Wisconsin does not have a state inheritance or estate tax. However if you are inheriting property from another state that state may have an.

At 765 percent Wisconsins rate is the 10th highest in the nation lower than that of only eight states and the District of Columbia. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. INHERITANCE AND ESTATE TAX.

Wisconsin tax structure. However there are 2 cases when an inheritance can become subject to taxation. The top marginal rate.

Wisconsin also has no inheritance tax but there is a possibility youll owe an inheritance tax in another state if you inherit money or property from someone living in that state. The property tax rates are among some of the highest in the country at around 2. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will.

What Is A Trust Fund How It Works Types How To Set One Up Estate Planning Checklist Trust Fund Budgeting Finances

Wisconsin Inheritance Laws What You Should Know

Minnesota Inheritance Laws What You Should Know Smartasset

Wisconsin Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

Cs 570 Programming Foundations Programming Assignment 6 Solved Ankitcodinghub Insertion Sort Selection Sort Assignments

Here S Which States Collect Zero Estate Or Inheritance Taxes

/shutterstock_304748270-5bfc3ba946e0fb002605af92.jpg)

Inherited Ira Distributions And Taxes Getting It Right

Japan Tourist Visa Template In Psd Format Fully Editable Japan Tourist Templates Online Activities

What To Do And Not Do With An Inheritance

Wisconsin Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wisconsin Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

Inheritance Tax What Is An Inheritance Tax Taxedu

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Estate Tax And How Does It Work Wisconsin Business Attorneys Wausau Eau Claire Green Bay

States With No Estate Tax Or Inheritance Tax Plan Where You Die